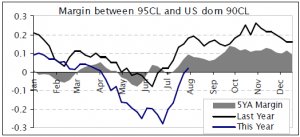

, as many retailers could not use imported beef in their formulations partly due to labeling requirements. US domestic left imported prices in the dust by US20-30c/lb. However, with weaker consumer demand and a spike in the US cow kill because of droughts, US domestic prices have since taken a hit. This has not flowed through to imported prices, which are actually climbing on the back of very tight imported supplies. The margin between US imported 95CL and US domestic 90CL has shrunk fast, with US imported 95CL prices back trading at a premium as of last week.

Supplies tight in US imported beef market

Tight supplies in the US imported beef market are underpinning imported prices at present. Most of the shipments arriving in the US the week ending July 23 were from NZ, but going forward, this will drop dramatically seeing there is about a 4 to 5 wk turnaround from when the cattle are slaughtered to when the boat arrives in the US. US imports from Canada, typically the No.1 supplier of imported beef, have dropped a further 6% this year to 114,638t from last year's low volumes. Imports from Australia are 66% higher to 117,181t but last years volumes were pathetic due to the strong AU$, wet weather in Australia and other attractive markets. Imports from NZ are on par with last year at 104,709t. Importers have bought hand to mouth as they've waited for prices to bottom out, but more are now starting to buy forward. There is more urgency to secure product, especially since there are growing concerns that higher US domestic prices will be needed to draw out more cows going forward.

Aussies on same page

There is limited product coming out of NZ at the moment so exporters have been firm on their offers of manufacturing beef to the US. Thankfully, our largest competitor Australia is on the same page as their offers are also increasing. The indicator for 95CL bull firmed to US$2.09/lb last week, while 90CL cow was US$1.97/lb. US domestic prices have been falling from an increase US slaughter, but they held last week, which is very encouraging for NZ exporters.

|

|

Market Briefs by iFarm.co.nz iFarm the leading source of agri-market prices, information and analysis for NZ farmers. Receive benchmark prices for the works, store and saleyard markets delivered direct to your inbox. Visit www.ifarm.co.nz or call 0508 873 283. |